Once again, I appreciate the great comments on Part II of this series that I posted earlier this week. There and in the comments of Part I, some of you zeroed in on two parts of this discussion that I’ve been especially interested in talking about.

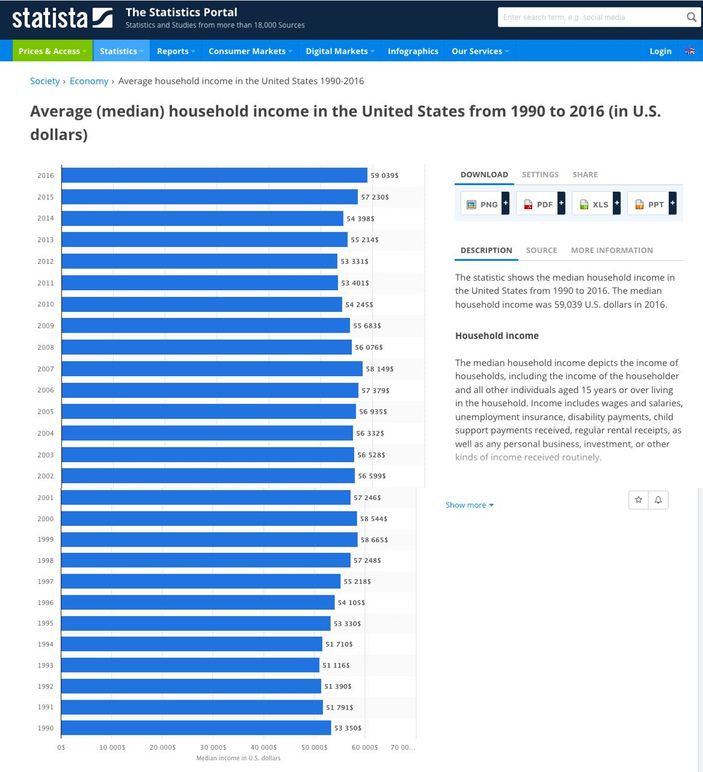

The first is the earning power of someone today verses in 1994. It’s been said in the comments by a couple people that, when adjusted for inflation, average wages for workers are less now than they were in the 1990s. An hour of googling turned up nothing on the official U.S. government Bureau of Labor website. The only dedicated info I found on the subject was the below statistical graphic on Statista.com showing median income in the U.S. from 1990 through 2016:

If it’s accurate, then median household income is higher than 1994, but roughly the same as it was in 1999 and 2000.

Whether this is accurate info and median household income is equal or greater compared to the mid-‘90s, doesn’t ultimately matter. Nor does it ultimately matter if today’s wages are lower than the mid-‘90s.

What ultimately matters when any one of us wants to buy something is whether we have the money to pay for it. And for many of us, when we get to the end of the month (or year) and look at what money we have leftover after covering our expenses, there isn’t enough to buy a new snowmobile. Believe me, I understand. But here’s where it gets interesting.

If I had to account for why most of us don’t have money leftover to buy a new snowmobile these days, I’d blame this (below):

That’s a bit misdirected actually. I can’t really blame the smartphone. I blame myself for spending money on it and the related, collateral stuff that serves as our electronic entertainment, including high-speed internet and cable television.

My household offers the perfect example. Each month I spend the following to enjoy all the virtual experiences and communications that I and my family (wife, two teenage kids) consume:

$310/mo. to Verizon for our four-phone plan

$11/mo. to Netflix

$40/mo. to my local internet service provider

$361 Total

That’s $361 that I spend every month so that I can surf craigslist, my wife can peruse Facebag, my kids can Snapchat and all of us can watch reruns of The Office (and Stranger Things for my daughter). Of course it also offers us conveniences like Google Maps, an always handy camera/video recorder, our music collections, a shared calendar to keep our lives in order and instant access to the most outstanding website in the world, ArcticInsider.

My family experiences varying degrees of joy flowing from these digital pleasure fountains, and there would be some serious protest if one of us terminated it all. But if I REALLY want to know where my brand-new snowmobile is lurking, it’s here.

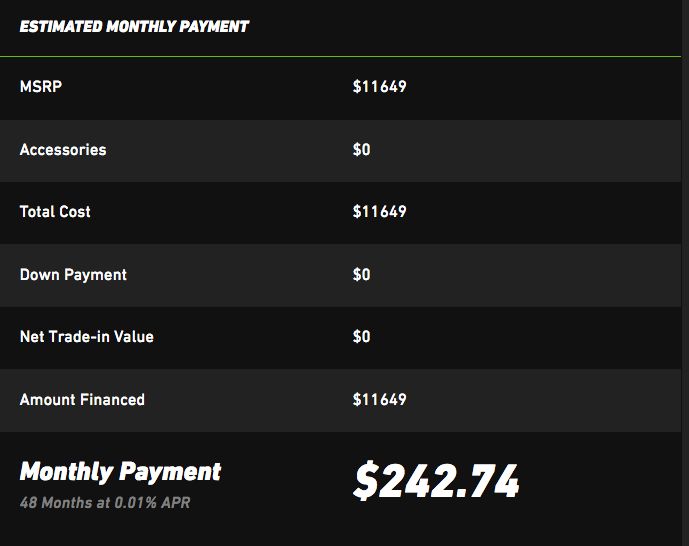

To confirm, I went to Arctic Cat’s monthly estimate calculator. There I typed in the dollar amount of a new 2018 ZR 6000, along with the ZERO-down, ZERO-interest deal that’s available now. I opted for a 48-month term rather than the available 60-month option. Here’s what it spit out:

At $243 bucks a month, I’d still have $118 leftover if I ditched all those gigabytes of entertainment. I could keep the high-speed Internet and continuing producing and reading this awesome website, and my wife could continue viewing that perfect life on display at Facebag. The kids would still have to learn to chat with friends in-person, without snapping, which would probably be a good thing.

Hmmm…

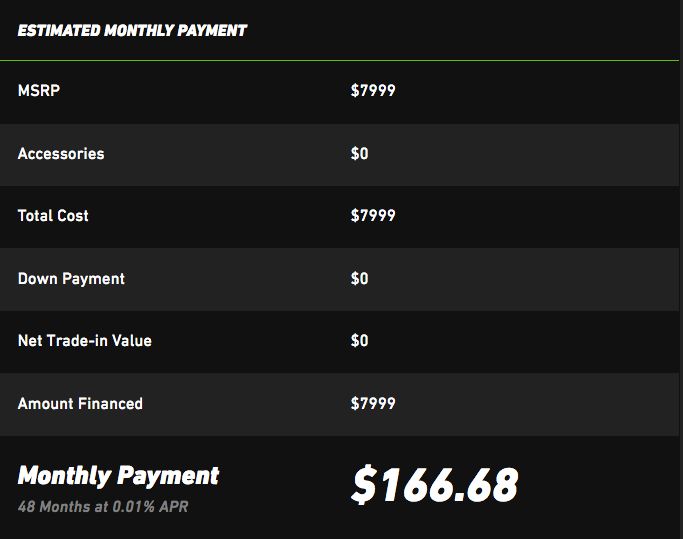

Just for the heck of it, I hit up the calculator again with the $7999 price that’s available on 2017 ZR 6000 models at some dealers in my region. With the ZERO, ZERO inputs my monthly payment for the next four years dropped a lot:

At $167/mo. for the snowmobile, I’d have an extra $194 leftover compared to the $361 I’m currently spending. With that I could keep the high speed Internet and buy some prepaid cell phones for all four of us and call it good. Or…

…I could purchase TWO 2017 ZR 6000s for the family!

And after four years we’ll own two kickass sleds. At that point we could default back to our virtual lives if we feel inclined.

This actually poses a real conundrum for yours truly. Because when I really REALLY think about it, I know that I get far more enjoyment, fellowship and satisfaction out of a half-dozen riding trips each winter than I do out of all this electronic crap that consumes my family’s time.

This is indeed a subject worth considering for my family and me. If we decide that we can’t go without the phone, perhaps our other monthly expenditures reveal an extra couple hundred bucks that can be diverted to other purposes?

We eat out WAY more frequently than my family did when I was growing up; the monthly grocery haul includes a lot of extra or unnecessary stuff; and our basement and garage seem pretty full with a lot of barely used stuff that we bought at Target. Stuff that, in hindsight, we never needed in the first place and that doesn’t offer meaningful experiences.

The more I think about it and look through our monthly credit car statements, the more I realize that we could find a way to own a new snowmobile without much sacrifice. Likewise, the more I consider the incredible memories I have snowmobiling with friends and family, the more evident it is that real-life experiences are a hundred times greater than virtual ones.

Somehow I was able to survive 1994 without a smart phone, internet and on-demand movies 24/7. Why couldn’t I do it again?

All of this serves to illustrate that, in my family at least, the lack of funds to buy a new snowmobile probably isn’t because the price of a new sled, but rather the choices we’ve made on the other things we spend our money.

I’ll wrap up this series next week.

Thanks for reading. I’ve really enjoyed taking a deeper dive into the subject.

Thank you John for this great series. I think it is so relevant to our sport and life in general here in 2017. It seems I spend a lot of time talking to my old riding buddies (the ones that still ride) about why we don’t ride as much as we useta back in the old days. Some of my best memories in life are snowmobile related. There is nothing like the camaraderie of going on outdoor adventures with your family or friends.

Take a look at http://www.theminimalists.com

I think I could surely get by with less E-tainment if it meant more time outdoors!

John, you need to update to this plan from Verizon.

Beyond Unlimited

1 line: $85/month

2 lines: $80 per line/month

3 lines: $60 per line/month

4 lines+: $50 per line/month

Paper-free billing and AutoPay must be enabled for these prices, otherwise you pay $5 more/month.

Unlimited 4G LTE data, but you could experience reduced speeds at times of network congestion once you exceed 22GB in a billing cycle.

Unlimited talk/text.

HD video streaming on smartphones (limited to 720p) and Full HD 1080p video streaming for tablets. There is no way to stream videos at 1080p or higher on phones — period.

Unlimited mobile hotspot data with up to 15GB of LTE speeds. If your laptop is tethered to your phone, video quality on your laptop will be limited to 1080p.

Free calling, texting, and data in Mexico and Canada.

John:

The loan calculator on the AC site does not work correctly with a value of 0%. If you put in any number greater than 0% (even 0.1%) you will get the correct monthly payment. However, at 0% it is wrong. Anyhow, tho, to get your 0% interest payment, just divide your total loan amount by 48. So your $278.41 should actually be $242.69, and your $191.18 should be $166.65. So how bow dah? Now you got an extra $60.25 in your pocket!

I made the same mistake myself; I bought a 6000 based on the calculator telling me my 0% payment would be approx $200/mo. Payment ended up being $168. I was planning on paying $200, so I could have (and should have) bought a 9000 instead.

This is an interesting series to be sure. But I have to add my two cents worth here. I know I am showing my age, and maybe I am living in the past, but let me say it straight up: today’s snowmobiles are Butt-ugly. We can analyze incomes and expenses until we are blue in the face. But when I see that pic of the 94 ZR, man that was a sled to cause your heart to race. Those were the days when you could not wait to see the new sleds at the dealer. The spring preview shows were packed.

Today? Oh sure, new technology may be the cool thing for some folks. but golly: it’s green and black so I guess it must be a Cat. And that yellow thing over there…must be that brand from up Quebec way eh?

Just me I guess…

John I’m the first to agree that I spend too much on the technology, but I did just use my smart phone to watch Tucker and Logie finish 1 and 2 and Arctic Cat sweep the podium in pro lite so I guess it’s worth it. Congrats to Christian Brothers racing.

Saying the sleds are ugly? Just skip that and say you are too old. And that is a big part of the issue, along with stagnant incomes. The world failed to reproduce the sledders of the 90s in the same quantity today. Of 10 or so guys I rode with 20 years ago only 2 of us have sleds today. Most quit when they started having kids, never introduced the kids to snowmobiling and never came back themselves. And only a small number of people will ever take up the sport on their own. High gas prices, tight credit and lack of snow haven’t help either.

But there could be better times ahead. The cheap sleds and easy credit this year have sold many sleds. So more people have the chance to ride and even the couple year old carry overs are pretty awesome sleds. And if they ride they will need new ones. And hopefully they will take their kids along. And a new generation will be born.

Super 8: Thanks for the tip, going to pursue that change on Monday!!!

Brandon: Thanks for the tip on the Arctic Cat calculator glitch. I did what you said and updated the story accordingly, which makes the math even more favorable.

Thanks for the comments everyone.

Don’t even get me started on what we pay for insurance a year……

I got a new phone right before Duluth one year because my old one fell out of my hoodie pocket into the urinal at Park X. Then I crashed backflipping at Duluth and broke my new phone. I had it in the pocket of my red, green and yellow baggy riding pants.

I really like the new 800 motor in the 2018 line up.

The nearest dealer to me list them in the upper 12k range on the low end to over 14K for a limited model.

My current sled isn’t very old so I can wait.

Not to be a downer because I love the hobby but comparing a cell phone plan to a sled payment isn’t the best comparison IMO.

Cell phones/data Internet=12 months/365 days a year availability almost guaranteed.

Sled payment 12 months a year. Sled usage 3-4 month window, not guaranteed.

A quote that continues to echo in my head from years ago;

“Snowmobiling, it’s a rich man’s sport…”

Greg R: I introduced the cell/internet/cable cost because I believe it’s a MAJOR factor in the difference in disposable income that people have today compared to 1994. Probably even the biggest factor.

I’m also comparing them, insofar as I ask myself whether my family gets more real satisfaction, enjoyment and meaningfulness from snowmobiling together, or having the electronic goodies. It’s a tough question for me to answer: if I’m really honest with myself, then I truly question why I’m spending so much on electronics. And yes, that is considering that I might only ride sleds a half-dozen days during a single year.

Snowmobiling is no more a rich man’s sport than having a cell phone is a rich man’s sport.

I am totally amazed at how LANX CREDIT SOLUTION were able to complete my job in 10 days. I read reviews about them online. people were saying good things about them and how they helped them fixed their credit score and also cleaned up their report. I contacted them via their email, LANXCREDITSOLUTION@GMAIL.COMand later called them with (310) 879 2541 to know how the process works and what’s obtainable because I was ready to purchase a home but my credit was bad and my score 543. I had some charge offs, lots of student loans and late payments and needed a quick repair. Ten days after we got started, my score increased to 798 and the charge offs, loans, late payment removed. There is so much to be thankful for.

This is an unforgettable experience my score was about 450. I couldn’t get anything at all due to low fico. I had a few negatives, my profile was laden with hard inquiries. So I went online and found a credit company on a blog I contacted them on (310) 879 2541, and after further agreement I made with him, I made a decision that if he can help me, I will forever be in their debt, they assured me they will do everything possible to fix my credit. After 7 days I couldn’t believe my eyes, they deleted everything bad on my credit profile including my hard inquiries and increased my score to 790 and added two trade lines. They made me the happiest woman on earth. Please if you have a similar issues contact LANX CREDIT SOLUTION. Here is their mail LANXCREDITSOLUTION@GMAIL.COM. thanks.

Oftentimes, it could seem unfair when you are unable to afford the basic things. not being able to acquire a home, car or loan. Simply because your credit score is low. I had suffered terribly due to a low credit score caused by eviction, late payments and hard inquiries. I had to contact LANX CREDIT SOLUTION a credit repair company. They literally saved me from my traumatizing experience. They increased my score and removed the negative and derogatory Items on my credit report. This review is in order to encourage you to do something about your bad credit. It took just 12 days for things to change everything. LANXCREDITSOLUTION at GMAIL dot COM

Oftentimes, it could seem unfair when you are unable to afford the basic things. not being able to acquire a home, car or loan. Simply because your credit score is low. I had suffered terribly due to a low credit score caused by eviction, late payments and hard inquiries. I had to contact LANX CREDIT SOLUTION a credit repair company. They literally saved me from my traumatizing experience. They increased my score and removed the negative and derogatory Items on my credit report. This review is in order to encourage you to do something about your bad credit. It took just 12 days for things to change everything. LANXCREDITSOLUTION at GMAIL dot COM